Innovating Risk Management for Bank and Financial Board Governance

Banks and financial institutions have very different risk management and corporate governance needs than companies in other industries. They are often more heavily regulated, have much more complex business models, and the stakeholders and governmental entities are significantly diverse. However, banks and financial institutions have always been pioneers in corporate governance best practices, relying on leading-edge technology, including board portal software, to manage their boards as effectively as possible.

The Chief Risk Officer (CRO) of a bank or financial institution is the foundation of a well-designed, centralized, risk-management structure. The CRO alleviates many of the issues that financial institutions often experience, such as the fact that risk management is often separated by product or organizational lines. As an executive officer, the CRO identifies, monitors, and manages risk on a bank-wide and an individual entity basis. The sophistication of a bank’s risk-management infrastructure also changes as the bank’s risk profile changes.

As banks have seen in the last two decades, risk mitigation is not only regulated by the balance sheet. Reputational risk is an important aspect of doing business with a large number of consumers. However, banks and financial institutions are well positioned to use the best practices in corporate governance. Since the regulatory environment is likely to create obstacles for banks and financial institutions for the foreseeable future, boards must keep up with the complexity even as they look for ways to streamline their operations with a bank portal software.

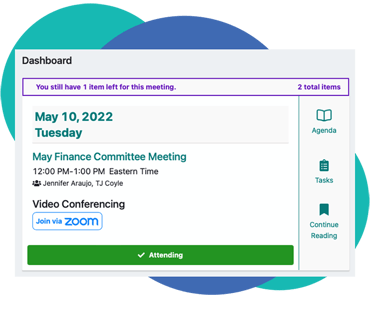

The integration of bank board portal software such as Govenda benefits banks and financial institutions by managing risk and maintaining accurate and secure governance. Govenda’s bank board portal has a rich feature set of tools that makes board administration more powerful and easier than ever. Twenty percent of Govenda’s trusted users are banks and financial institutions. Scheduling and preparing for board meetings, managing board communications, and board compliance are simplified, and that gives a bank or financial administrator more time to help the board combat other complex issues.

Organize, Manage, and Govern Securely

The environment for banks and financial institutions has changed noticeably since the Great Recession. While political parties come in and out of power, the regulatory landscape for banks is constantly evolving. The global market is more intertwined and governments are constantly passing hosts of laws and regulations for financial institutions. The board management and governance of these institutions need an increasing amount of knowledge to compete and thrive in this rapidly changing environment. After the Great Recession, Congress passed the Dodd-Frank legislation, and now Congress is considering rolling key provisions back. Whatever the outcome, banks and financial institutions will need to adjust. In addition, it’s important for banks to accurately keep track of the risks they may be taking on a daily basis.

I ntegrating a bank board portal software streamlines the process of cataloging these countless laws and regulations by implementing one common secure platform for document organization. Govenda’s bank board portal offers our customers a safe and secure cloud-based system that encrypts data at the highest level. Manage bank governance documentation with Govenda’s easy-to-use drag-and-drop document library that tolerates multiple file types. Users can read, annotate, and take notes on all documents that sync across all devices. Govenda’s offline access also allows board members to govern and manage risks while traveling or when internet access is sparse.

ntegrating a bank board portal software streamlines the process of cataloging these countless laws and regulations by implementing one common secure platform for document organization. Govenda’s bank board portal offers our customers a safe and secure cloud-based system that encrypts data at the highest level. Manage bank governance documentation with Govenda’s easy-to-use drag-and-drop document library that tolerates multiple file types. Users can read, annotate, and take notes on all documents that sync across all devices. Govenda’s offline access also allows board members to govern and manage risks while traveling or when internet access is sparse.

Generally, governance at banks and financial institutions have more experienced board members than in most other industries. Usually, the board includes a balance of skills, diversity, and experience that will enable it to exercise effective oversight of the institution. Board members also consist of a sufficient number of outside directors on the board, as they are often stronger monitors than firm insiders. This can make communication for board members an arduous task. Govenda’s searchable directory allows users to easily locate members of the board or other unique committees and to view their profiles and contact information. Communication is streamlined when administrators and board members can securely message individuals, committees, or the entire board with their phone or tablet.

Govenda has Committees Covered

For a bank or financial institution, the landscape is complex and board committees play an even greater role in the company. Committees and groups can help the board get its work done more efficiently, and provide an easy way for members of the board with specialized expertise to receive more detailed information. All systemically important banks generally establish a Risk Committee as part of the board. It’s good practice for these committees to be made up mostly or entirely of independent or non-executive board members, and their Chairs should not be the Chairs of any other committees. Members of the Risk Committee include directors who have experience in risk management practices and issues. Its responsibilities include making recommendations about the institution’s risk appetite and strategies to the board, periodically reviewing and updating the bank’s risk policies, and ensuring that management adheres to these policies. The distribution of information in a secure manner is of utmost importance.

Govenda’s bank board portal allows easy access to all materials through Apple and Android apps on mobile phones, tablets, and web browsers. Board administrators can also set three levels of security permissions to limit access to data and files. Administrators can give blanket access, committee access, or user management access. Limiting risk and expanding the use of Govenda’s bank board portal to multiple groups by keeping sensitive information limited to certain groups or committees is essential.

Complete the Transformation

Banks and financial institution boards of directors are generally the shareholders’ first line of defense in governance and have overall responsibility for the institution. One of the most important attributes of a good board is its ability and willingness to challenge management and engage in productive dialogue. Among other things, the board should help to ensure that transactions with related parties are reviewed, and reinforce the bank’s principles throughout the organization. It should also help establish and maintain an appropriate risk governance framework that includes deciding how much risk the bank is willing to take and reviewing key policies and controls to make sure no one exceeds that level. Govenda’s bank board portal removes cumbersome communication, unsecured documentation, and disorganized practices from board and committee members’ experience. Board members know the importance of giving back and the critical impact of providing external guidance to a company. Govenda’s bank board portal helps board members and boards they serve, specifically in banks and financial institutions, by providing even more valuable guidance.

Other posts you might be interested in

View All PostsSubscribe to email updates

Get updates delivered directly to your inbox.