Boards of directors must keep up with the rapid pace of change across industries. The role of the board today is fundamentally different than it was in past years. Boards need to make necessary changes in their organizations to facilitate continued growth.

This shift in governance and boardroom dynamics has been largely driven by regulatory changes, increased scrutiny, empowered investors, technological advancements, social activism, greater competition, and the general global economic environment.

The board of directors has always been responsible for the company’s strategic direction, financial performance, and risk management, and those responsibilities haven’t changed. The traditional board of directors is being replaced by a new type of board that’s more agile and responsive to the needs of the company. They need to prepare for short-term results and long-term sustainability.

In addition to their historical roles of hiring, evaluating, and firing senior executives; setting financial goals; determining strategic direction, mitigating risk, and monitoring overall performance, the board of directors has new responsibilities to their company.

9 Factors Impacting the Future of Boards of Directors:

-

Stakeholder Governance

The shift to stakeholder governance is accelerating, and corporate boards need to prepare for the change. The traditional model of shareholder governance—where boards and businesses prioritize the value to the shareholders—is quickly losing ground to the practice of stakeholder governance, which considers the interests of profits, people, and the planet.

-

Remote Boards

Technology has made it possible to do more work remotely, which means that people can be on a board without being physically present in an office. This has led to some companies having virtual board meetings, where all members are not in one place at one time. Just as remote work has enabled companies to seek the most qualified candidates from around the world, boards aren’t limiting their search for new directors based on geographical convenience.

-

Increased Diversity

There has been growing momentum to increase board diversity—more women, more people of color, more LGBTQ+ representation. Thanks to mounting evidence of the efficacy of more diverse boards, boards will continue to become more global and more diverse. They’ll have a wide range of skill sets and perspectives to help them make better decisions.

-

Varied Expertise

Forward-looking boards also need directors with more diverse board experience to manage their new responsibilities. For example, boards have always included financial, operations, and industry experts. Now, they also need advice from experts in technology, risk management, climate change, and other ESG-related issues. Whether those experts are board members, executives, employees, or outside advisors, boards of directors will continue to communicate and collaborate with many more people than in the past.

-

Director Turnover

Connected to the idea of boards needing a wider range of expertise than they have in the past is the trend toward shorter tenures for board members. To make sure they always have the right mix of competencies, boards are shortening overall term limits (shorter term limits also make room for diverse directors). Also leading to the shortening of term limits is the fact that younger board members don’t want to commit to 6-10+ years. This has led to the need for a board of directors to have comprehensive board succession plans.

-

Greater Agility

The pandemic proved that there is a need for boards to be more agile. During the pandemic, boards quickly went from quarterly meetings and intermittent communication to weekly, remote board meetings and daily (sometimes hourly) updates. And as the shift to stakeholder governance continues, and boards become focused on more than just shareholder interests, directors have a much broader range of responsibilities.

-

ESG Issues

Pressure from regulators, investors, consumers, and more, is precipitating the evolution to stakeholder governance. That means boards are not only responsible for increasing shareholder value. And it’s why many companies have started to focus on ESG issues and transparency. In the future, boards and businesses will continue to be more open about their activities, disclosing their plans and strategies to ensure that they are accountable to their stakeholders.

-

Featured resource: ESG Impacts, Risks & Opportunities For The Construction Industry

-

-

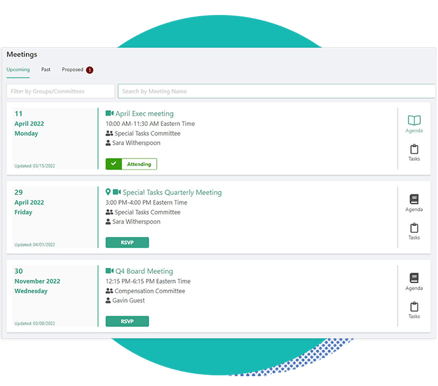

Technology Disruption

Today’s boards need to make sure their organizations are prepared for the opportunities created by transformative technology. Tech innovations are impacting every aspect of how business gets done, up and down the supply chain. Board members themselves aren’t immune to the influence of technology to help them increase productivity. With the rise of board management software boards can now be more engaged in the boardroom and meet the challenges of remote board meetings.

-

Increased Security

Increased SecurityThe increase in cyber crimes is front and center for most boards, and the need for cutting-edge cybersecurity measures is clear. In addition to understanding and mitigating any potential cyber threats to the company from outside forces, the board must also ensure that lax protocols or careless members don’t make the board itself a liability. All board-related information should be housed in a secure board portal software so that board documents aren't scattered across multiple unsafe locations.

Keeping Up with the Pace of Change in Board Management

Historically, the board’s role has been to provide oversight and guidance to the company, but now it‘s becoming clear that they need to provide more strategic input on top of their traditional oversight. The board's traditional role has been to ensure that the company has a clear direction and that it meets its goals. Boards have been (and continue to be) responsible for overseeing the company's performance, ensuring that it is meeting its objectives, and making sure that there are no conflicts of interest in the decision-making process.

As corporate governance evolves, the board of directors is slowly moving towards stakeholder governance, including increasing transparency and oversight, encouraging diversity, embracing technology, and boosting security. Future-looking boards must be nimble and understand that board management technology is the foundation for the way boards do business in the short and long term.

Other posts you might be interested in

View All Posts

University of Pittsburgh Katz School of Business Adopts Govenda Board Portal Platform

Read More

Preparing for Positive Engagements Between Directors and Shareholders

Read More

Impact Investing Sets the Tone for Our Future

Read MoreSubscribe to email updates

Get updates delivered directly to your inbox.